Artificial Intelligence (AI) Market by Technology (Machine Learning, Natural Language Processing, Image Processing, Speech Recognition), and Industry Vertical (Media & Advertising, BFSI, IT & Telecom, Retail, Healthcare, Automotive & Transportation, and Others) - Global Opportunity Analysis and Indu

Artificial Intelligence (AI) Market Overview:

The global artificial intelligence market size is expected to reach $169,411.8 million in 2025, from $4,065.0 million in 2016 growing at a CAGR of 55.6% from 2018 to 2025. Artificial intelligence has been one of the fastest-growing technologies in recent years. AI is associated to human intelligence with similar characteristics such as language understanding, reasoning, learning, problem solving, and others. Manufacturers in the market witness enormous underlying intellectual challenges in the development and revision of such a technology. AI is positioned at the core of the next gen software technologies in the market. Companies such as Google, IBM, Microsoft, and other leading players have actively implemented AI as a crucial part of their technologies

Get more information on this report : Request Sample Pages

The report focuses on the growth prospects, restraints, and artificial intelligence market trends. The rise in number of innovative start-ups and advancements in technology have led to increase in investment in artificial intelligence technologies. Moreover, growth in demand for analyzing and interpreting large amounts of data is boosting the demand for artificial intelligence industry solutions. Furthermore, development of more reliable cloud computing infrastructures and improvements in dynamic artificial intelligence solutions have a strong impact on the growth potential of the AI market. However, lack of trained and experienced staff can hinder the growth of the artificial intelligence market.

The study provides Porter’s five forces analysis of the AI industry to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the artificial intelligence market growth. Report also provides AI industry forecast for the period of 2017 to 2022.

Get more information on this report : Request Sample Pages

Segment Overview

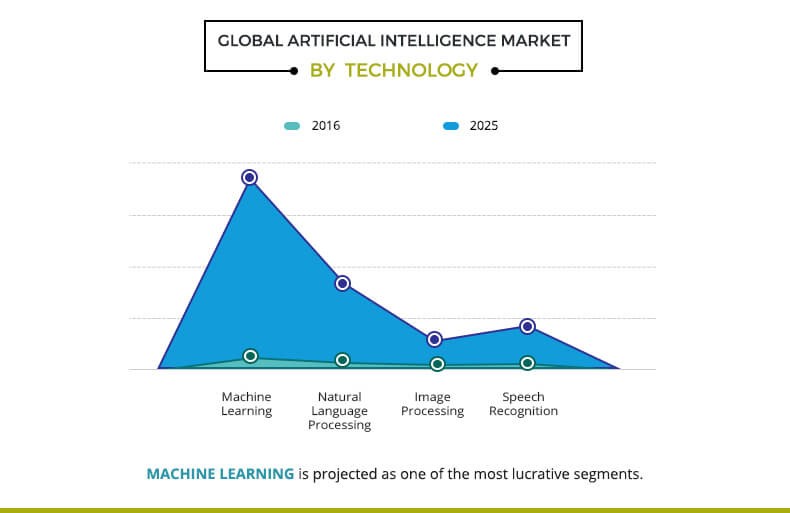

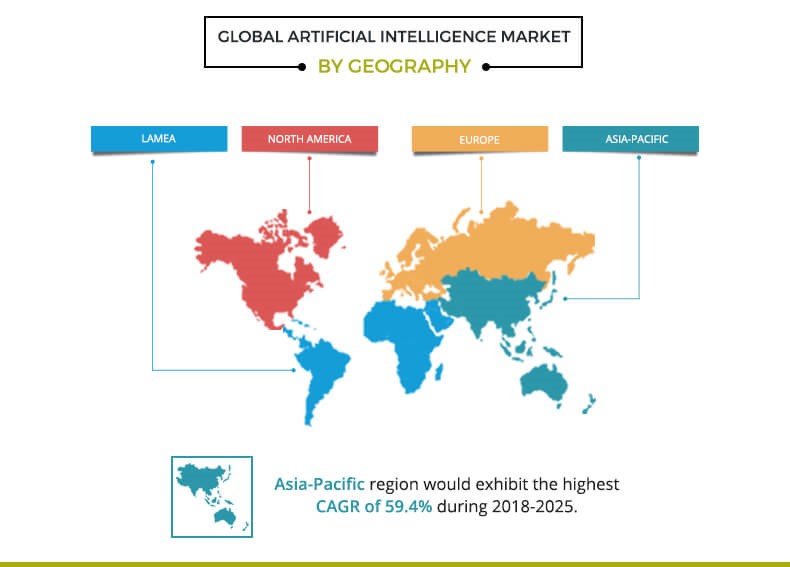

The AI market is segmented by technology, industry vertical, and geography. The various technologies are sub-divided into machine learning, natural language processing, image processing, and speech recognition. Based on industry verticals, the market is categorized into media & advertising, retail, telecom & IT, healthcare, automotive & transportation, and others (agriculture, law, educational institutions). Geographically, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Get more information on this report : Request Sample Pages

According to technology segment, artificial intelligence market size was highest for the machine learning segment and is expected to maintain this trend in the coming years, owing to increase in demand for artificial intelligence industry solutions.

In 2017, North America region contributed for the highest AI market share and is anticipated to secure the leading position during the forecast period, owing to the presence of key companies and large investment in the artificial intelligence market.

Competition Analysis

Competitive analysis and profiles of the major artificial intelligence market leaders, such as Alphabet (Google Inc.), Apple Inc., Baidu, IBM, IPsoft, Microsoft Corporation, MicroStrategy, Inc., NVIDIA, Qlik Technologies Inc., and Verint Systems Inc (Next IT Corp) are provided in this report. The key strategies adopted by the key players from 2015 to 2018 were product launches, acquisitions, and collaboration.

Top impacting factors

Growing investment in AI technologies and growing need for analyzing and interpreting large amounts of data are expected to drive the growth of the artificial intelligence market. However, lack of trained and experienced staff is expected to restrict the growth of AI industry.

Increasing investment in AI technologies

The ability of the AI technology to analyze the collected data efficiently and forecast decisions through crucial algorithms helps in productivity improvement; for instance, Netflix suggests movies on the basis of users’ previous viewing experiences. In the current business scenario, AI has revolutionized the way of business management through integration of workflow management tools, brand purchase advertising, trend predictions, and other tools. These are the major factors of the increasing investment in AI technologies and machine learning market. Moreover, many small startups and tech companies have been investing in adoption of open-source AI platforms to achieve higher efficiencies in their value chains. Moreover, the growing availability of low-cost quality AI technologies is expected to also contribute to the growth of the market.

Growing need for analyzing and interpreting large amounts of data

AI has varied application areas including media & advertising, finance, retail, healthcare, automotive & transportation, agriculture, law, educational institutions, oil & gas, and other industries. This has driven the market of AI across the globe, owing to developments, such as self-driving cars, space exploration, accurate weather predictions, and others. Furthermore, AI is expected to affect healthcare advancements, owing to its ability to analyze huge amounts of genomic data and ensure more accurate treatment and prevention of medical conditions.

Lack of trained and experienced staff

Development of AI is possible after handling complex algorithms. Further, management of AI and automated systems is sometimes difficult. This requires exceptional software engineering skills and a notable experience of addressing distributed and concurrent programming or debugging with communication protocols. However, many regions, particularly the emerging economies, lack people with such skills. Hence, lack of skilled workforce is a prominent restraining force for the market.

Key Benefits for Stakeholders

-

The report provides an extensive analysis of the current and emerging market trends, and dynamics in the global artificial intelligence market.

-

In-depth analysis is conducted by constructing market estimations for the key market segments between 2018 and 2025.

-

Extensive artificial intelligence market analysis is conducted by following key product positioning and monitoring of the top competitors within the market framework.

-

A comprehensive analysis of all regions is provided to determine the prevailing opportunities in these geographies.

-

Key market players within the artificial intelligence market are profiled in this report and their strategies are analyzed thoroughly, which help in understanding the competitive outlook of the global artificial intelligence market.

Artificial Intelligence (AI) Market Key Segments:

By Technology

- Machine learning

- Natural language processing

- Image processing

- Speech recognition

By Industry Vertical

- Media & advertising

- BFSI

- IT & Telecom

- Retail

- Healthcare

- Automotive & transportation

- ucational institutions)Others (agriculture, law, ed

By Geography

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- Rest of Asia-Pacific

- LAMEA

- Latin America

- Middle East

- Africa

Key Players

- Alphabet (Google Inc.)

- Apple Inc.

- Baidu

- IBM Corporation

- IPsoft

- Microsoft Corporation

- MicroStrategy, Inc.

- NVIDIA

- Qlik Technologies Inc

- Verint Systems Inc (Next IT Corp)